At most B2B companies, the marketing/sales relationship has taken a wrong turn.

Sellers are taking marketing into their own hands.

They’re emailing prospects, investing heavily in third-party intent platforms like 6Sense, and generally doing their own messaging and outreach.

And they’re not using Marketing’s expensively produced content.

The fact that they’re ignoring most MQLs while sourcing their own leads should tell you something is drastically wrong.

And something is drastically wrong. We saw a client absolutely crush its marketing goals — increasing traffic to its website and content by 70%, overachieving ambitious pipeline goals by 42%.

But revenue didn’t follow.

Because the B2B go-to-market playbook — what worked before — no longer matches the reality of how customers buy.

You can see the results of this in the growing lack of trust between sales and marketing teams. And you can see it when most marketing teams fail to deliver revenue anywhere near what they should be contributing (and getting credit for).

You can see it in falling CMO tenure.

Breaking this cycle isn’t going to be easy but it’s absolutely worth it.

Companies that steer Sales and Marketing in the same direction — both a herculean task in itself and a symptom of doing a lot of other things right — are crushing their targets.

Hubspot research shows that B2B brands with aligned sales and marketing teams:

- Deliver 20% annual revenue growth as opposed to a 4% decline in non-aligned companies

- Have 38% higher win rates

- Enjoy 14% faster sales cycles

And Forrester adds 27% higher margins to this growth.

It’s a profit windfall.

So why are most marketers so stuck — and how can we get unstuck? We have thoughts.

Fatigue, a dry hacking cough and shit-talk

When the B2B sales and marketing relationship is unwell, you’ll see some very clear symptoms. Think:

- Sales reps ignore up to 70% of sales leads provided by marketing — often throwing them out without even trying to qualify them because they’ve learned it’s a waste of their time. And they’re not saying nice things about Marketing.

- 60-70% of your content is never used because Sales doesn’t see the relevance. We don’t think this is usually the content’s fault. Sales just doesn’t have the context, maybe because they’re too busy running their own rogue marketing efforts …

- 80% of marketing leads die in the funnel.

- And the biggest symptom: Marketing isn’t generating at least a third of company revenue.

This is basically everyone: Fewer than 10% of companies think their sales and marketing teams are strongly aligned.

But these symptoms actually indicate a larger problem: Marketing and Sales are operating on an outdated model that assumes sellers have a lot more influence over the buying process than they do — when in reality, buyers have taken the power into their own hands.

And that’s if Sales even gets to talk to a buyer. Sales/prospect interactions are the tip of a very large iceberg these days. By the time a buyer signals buying intent, they’ve done all kinds of research and formed their own opinions.

LinkedIn’s research shows only 5% of B2B buyers are actively in the market at any time. Right now, most companies are killing themselves fighting over that 5%. They’re hemorrhaging money in a street fight with other vendors.

And they’re doing it when the fight’s already over because the buyers have mostly made up their minds.

Trying to earn buyers at the very last minute when they’re no longer convince-able is like showing up to the Olympics without having trained. You can kill yourself practicing that week but it’s nothing without all all the work that comes before.

In this case, the work is talking to prospects before they’re actively in the buying stage. People buy from the companies they spend time with, and you have to earn the opportunity to talk to them when it’s go-time by investing in brand-building activities that deliver no immediate payoff.

Brands that don’t do this are often jumping on any sign of interest from a so-called buyer — even if all that person was trying to do was read “3 ways to improve your data strategy” after they got bonked over the head with it — and calling it a lead.

When Marketing hands over a ‘lead’ like this to Sales, we annoy prospects and sellers alike. No one wants to get harassed to buy an expensive product they heard about five seconds ago. We haven’t earned the right to talk to them yet.

It’s not that marketing content to people in the early stages of a potential buying journey is a bad move; in fact, we recommend it. It’s just that the lead is far from ready. It needs time, love and patience from marketers.

Tough medicine

While it’s nearly impossible to change minds once buyers are at the moment of buying, there are lots of things marketers can influence, including whether your sales team gets the chance to talk to buyers at all.

You can earn that chance by providing useful and compelling content for every stage of a buying journey, starting with problem awareness.

Or maybe before that, making them aware there is a problem or missed opportunity in the first place.

And Sales, on its side, needs to let Marketing lead on messaging — and embrace data.

An ideal journey will look more like:

- A prospect — more like a zygote at this stage — realizes they want to do something better or more efficiently

- They go to Google seeking some insight and Bam! your content shows up to help them identify the contours of the problem

- Marketing spots some signals indicating more interest and starts to target mid-funnel content at the zygote-turned-fetus, plus others in the buying committee

- And you nurture them into further consideration until …

- Contractions get closer and it’s time to turn them over to sellers

- … Who know exactly what kind of care and messaging you’ve already provided and can deliver a pitch that builds on it

But all this takes trust between Marketing and Sales — and a commitment from your company to invest in the long-term stuff that doesn’t produce MQLs right away.

We’re not saying it’s easy. Three-quarters of CMOs are under pressure to show ROI faster, and nearly half face pressure to prove marketing will drive long-term growth.

Getting better will take a fundamental restructuring of how Marketing and Sales operate. Because right now, we treat our partnership like it’s a relay race, except Marketing is running toward the wrong post and Sales is re-running the track from the beginning.

A better metaphor might be a football team (that’s ‘soccer’ for you Yanks) where you have each position running in coordinated actions, and a multi-talented striker who can do it all.

It’s also gonna take completely rethinking our KPIs to reflect the new reality of how buyers operate. Right now, they incentivize only short-term lead gen when they need to do a lot more long-term activation.

And they need to get serious about lead-scoring so sellers know what play they’re walking into when they call.

And companies need to stop spending entirely too much effort on disappointing attribution initiatives that are more about who gets the credit for a sale than how to invest marketing dollars wisely.

It’s early days, but some companies are thinking about collapsing sales and marketing teams under one roof, with one shared set of goals. The cool kids are calling it RevOps. Gartner explains RevOps isn’t so much a function as a better way to align the organization.

What’s next

B2B buying has changed. Sales and Marketing have to change, too.

Breaking silos is always hard work but operating the way we are now — going after the wrong things and wasting effort — is also hard. We need to evolve the B2B go-to-market playbook to reflect how prospects move today: with lots of autonomy.

Influence can still absolutely happen, but it has to be built on trust, not short-term tactics that annoy buyers. Think brand activation and nurturing.

And we need to evolve so Sales and Marketing work together, doing what each does best. That might mean revisiting — or instating — service-level agreements, but also updating KPIs so they incentivize wise choices over vanity metrics like number of MQLs.

If you’re up for the challenge, our new workbook lays out how to do the foundational work of aligning sales and marketing teams, setting new KPIs, nailing targeting, and auditing your marketing ops.

Ready to see a Velocity blueprint in all its glory? Follow this link to download your free copy of The Big, Beautiful, B2B Blueprint now.

I don’t want to hear about spear-fishing ever again.

I’m Charlie, the head of ABM at Velocity. And I have a bone to pick with tired ABM metaphors.

Good ABM isn’t about hunting targets and herding them into a funnel. Those strong-arm tactics may deliver a few metrics but they’re not how you win revenue. All the power is in buyers’ hands and they’ll come to you when they’re good and ready.

Which leads us (excuse the pun) to what ABM should do, which is apply modern tools and processes to an old strategy: find your friends and nurture those relationships. Do this and selling will be easier, because it’s win-win.

Sounds good, doesn’t it? But in practice, ABM tends to fall short of this promise. Here’s why.

The missing ABM element

In its early days, we thought about ABM in terms of targeting: using big data and automation tools to home in on top prospects. But it wasn’t enough to deliver the ROI we all expected.

So what was missing?

Partly, it’s about missing the real ICP. Data is only the starting point, but quite often it’s flawed. And without real insight into your customers, targeting tends to end up looking like demographics: company size, role, etc. What it doesn’t do is find the personality type most B2B sales need: someone who can be galvanized to shake off their inertia and buy your shit.

This plays into the vicious sales-marketing-at-loggerheads cycle. Because when your targeting isn’t quite right, then your leads aren’t right. And we all know what happens when sales gets fed dud leads: they roll their eyes and neglect even the leads worth pursuing.

To make matters worse, when they do talk to people, they trot out the same tired sales pitch they’re comfortable with. Not that one relevant to the campaign that piqued the prospect’s interest in the first place.

And that’s a major problem. Because Marketing and Sales remain irritatingly, intractably, impossibly siloed. (In your head, you’re now hearing Angela Lansbury sing “Tale as old as time” … well, you are now).

It’s too bad, because when Marketing and Sales work together and are guided by a well-designed strategy, everything falls into place. I’ve seen it happen.

ABM is a long game

ABM’s timeline is long, and it takes lockstep strategy to keep it all together. While marketing is building credibility as an insights provider and generating content, sales needs to be out establishing personal relationships with key targets and securing meetings and speaker slots.

It’s not easy to point a sales and marketing coalition in the same direction — and keeping it that way for 15 months is much harder. So having a clear end goal to anchor all the work is critical.

And yes, ABM is hard work. But coordinating long sales and marketing motions pays off a lot better than sellers relying on hunches, networking and brute-force door-knocking while marketing does a bunch of stuff we hope helps.

That way leads to a whole lot of inefficiency — and wasted opportunities.

But meh ABM is probably worse.

Quite often, the issue is timing. If it’s not a good time for your ICP to hear from you, you’re not going to force them to listen. And one of the cool things about ABM right now is there are a lot of ways to pick up on signals about when it is the right time.

But sometimes, ABM just loses momentum. There’s no feedback loop from Sales to adjust your nurture, you don’t know that a prospect has already talked to someone in your org, and that they need something different now.

And partly, it’s about creative: because the best-laid strategies can be brought down by dull, unoriginal or off-the-mark creative. ABM is about getting personal — and that requires having a personality.

Stuff is changing in ABM. Let’s talk about it.

ABM pros have recognized we can’t strong-arm prospects into our funnels. We have richer data — and more conversations with Sales — to figure out who the natural fits are, when it’s the right time to talk to them, and what to say.

And we have better ways to test our hypotheses and adjust as we go.

So stick with me for the next blogs while I spill the tea (or beans, if you’re Stateside Gen X). And chat me up on LinkedIn, I’d love to bend your ear about ABM. It’s not the kind of topic I get real far with at dinner parties.

I have a lot to share about ABM. Stay tuned for more…

Even before AI and Google SGE came gunning for everyone’s search traffic, B2B was struggling with SEO. Despite endless effort, lots of pages languish in SERPs while the cost of paid search keeps growing. It’s a problem.

Even the pages that get that sweet search love aren’t doing brands a lot of good — often because they’re not optimized for terms that matter to qualified buyers. (So what if you win big on “What is data architecture?” when you’re trying to sell to experienced IT leaders?)

In perhaps the saddest cases, the pages that “win” SEO by effectively playing the system fail to elicit real interest. Content that lacks depth, credibility and a point of view is inherently unsticky.

And the state of SEO affairs is about to get worse. Actually, our CEO Stan recently wrote an article on the B2B SEO malaise, and SGE is just a part of it.

AI — ChatGPT, Google SGE, all of it — is going to crack the internet wide open and scramble everyone’s SEO investments.

But honestly: we think this might be a good thing in the long run. We’ll get to why after the scary stuff.

Will AI replace SEO? First, the bad news.

GenAI seems like a good thing, unless you’re a writer, designer or human.

OK, we don’t think generative AI is all bad: there are certainly efficiencies to be gained by letting AI do the boring bits — and we all need to get smart about using them or we’re doing whoever pays our bills a disservice.

But not everyone is exercising such restraint: “content at scale” is a certain type of marketer’s sickening rallying cry. Loooots of companies are chomping at the bit to use AI to flood the internet with search-optimized drivel. Sure, generative AI tools like ChatGPT can produce decent aggregations of other people’s knowledge — about as well as most junior writers or interns. Editing can take it home.

But frankly, marketing humans have been producing that kind of content for a long time. There’s some user benefit in aggregation: to our users, who can see the topic digested quickly or through a certain lens — and to creators, who can use it to earn search traffic.

But that value is going away. Blame AI. Blame marketers. Blame Google.

If your intern can produce content without any point of view — and without having any substantive knowledge on the matter — then it’s at risk because anyone can do it. ChatGPT can do it at scale (cue an existential ‘ick’).

Search engines — and their users — are about to experience the Great Blanding. AI content averages out all the other content, smooths out the rough edges, siphons off any taste. It’s the equivalent of someone showing you their ‘Live, laugh, love’ sign when you try to get to know them.

(But if we’re honest, B2B content already had a poor track record for telling stories with mojo and humanity and a real point of view).

Users don’t like the AI-driven content that’s flooding us. Neither does our overlord, Google.

But right now, that kind of content is effective, and at a scale that’s jeopardizing SEO investments. What took six months to build might be undone in a week’s worth of work by someone churning out GenAI content.

SGE’s impact on SEO: Google adds generative AI search and an algo update to the chaos

As the dominant search engine, Google can be a bit of a meanie sometimes. The dominant search engine is trying to cut the middleman out of searches altogether. They’ve already tested and are talking about rolling out Search Generative Experience (SGE). It’s like ChatGPT for the internet: you ask a question and get an answer.

Without ever visiting a website.

Of course, there will be problems: just like with ChatGPT, some of Google’s generative AI search answers are going to be hallucinations. Worse, they’ll sound right but be full-on bullshit. Sure, that was always a problem with internet content, but it’s easier to tell on a website how likely the answers are to be reliable.

The implications are obvious: it’s going to steal your traffic the way rich snippets did, so Google can sell more ad space.

We think the good news is the flurry of helpful content guidance updates and the big algo change Google rolled out in 2023 to prioritize content that truly serves humans — not low-value, AI-generated shit. They’ve summarized the principles as Experience, Expertise, Authoritativeness and Trustworthiness (E-E-A-T). It’s a set of standards that will reward content that serves up the best user experience.

As with every algo change, SEOs are rushing to update their strategies. Which is just as Google would have it. Good SEOs are responsible for helping their brands play by Google’s rules — which Google loves — while bad ones try to game the system.

Google is also cagey about its ranking factors because it doesn’t want SEOs to game the system. But we (and some of our very advanced search clients) think Google looks for things like:

- Named authors who are actually experts. Our client Tebra has gone very deep with this: their content site, The Intake, names every author and their medical proofreader if relevant. It’s as far from ChatGPT as you get — it’s content with a human endorsing it. And a human who knows what the hell they’re talking about.

- Original research. You’re not just aggregating other’s content or making up thoughts. Google will reward you when you produce credible new information. Think surveys and other original data. (Also consider: digital experiences that produce survey data).

- Content overall still needs to abide by SEO best practices: technical site performance, content that’s relevant to your brand and written with intent to match keywords, off-site endorsements (AKA backlinks) from authoritative domains and other ranking signals still matter. Quality indicators like grammar still matter, too, but what’s new is that sources should be cited and reputable. If it’s good enough for your professor, it’s good enough for Google.

- Google wants to reward sites, content and experiences that best serve the user — in terms of finding what they need quickly and being a reliable source they can trust.

So the good news we promised several hundred words ago…

In the long run, the AI content apocalypse may prove a good thing. B2B buyers don’t want shallow answers; they want deep insight, credible information, and — hear us out — not to be bored. And they’re not going to get that from SGE or ChatGPT.

And the sheer scale of all that AI content is very likely to collapse under its own weight, with Google helping it along with some well-timed kicks to the shin. The just-for-search content — which was already a big problem, whether a content grindhouse, an intern or ChatGPT wrote it — should die.

So who’s going to win in this new world? One thing never changes about SEO: play the long game with integrity and commitment, and you have a good chance of coming out on top. In the end, the companies who really invest in original, expert-created, useful content that users want will win.

That doesn’t mean you don’t need an SEO strategy. It just means your SEO strategy has to get smarter. As smart as your buyers.

Lower-volume, higher-quality content is likely to get outsized results because the scale of the content Google favors will actually go down. It can’t be scraped and repackaged from the internet; it needs something special. Heart, personality, an opinion, unimpeachable facts.

It’s not just search that’s changing

A lot of smart people in B2B are talking about the era of humans, too. For instance, Zapier’s very smart CMO predicted B2B will have its creator moment, taking a cue from influencers.

Because it turns out, people trust people — not brands. (Or robots). Companies may start to put their best thinkers forward.

Some other trends:

- LinkedIn is testing a feature to allow brands to pay to promote their employees’ posts — and the beta test showed a 70% higher CTR and 60% increase in engagement (for thought leader promotions vs traditional static ads).

- Some people may make a living as B2B thought leaders and do paid collaborations with brands they trust.

- Google isn’t the default search engine of choice for younger users. Huge numbers are going to TikTok or Instagram first. In B2B, there are other search engines: think Capterra, G2, YouTube, the AWS marketplace, forums and even Reddit.

- Having a person own the content adds credibility for Google and trust for readers. People are already suspicious and bored by generic, unowned content. Having a point of view and a voice is gonna be stickier for Google and for your users.

Gear up for new battles

2024 is going to bring lots of changes. SGE’s impact on SEO and the content-at-scale-pocalypse are scary — but maybe a long overdue wakeup call for B2B SEO. We all need to get smarter and more sophisticated about how we reach and actually engage the prospects we want to talk to.

What are you predicting? Does AI’s HAL 9000-like role in the B2B-SEO malaise have you horrified? Have your say in the comments.

A lot of B2B tech firms struggle with SEO.

Everyone recognises that it should be a key weapon in the arsenal, but most tech firms’ organic SEO performance – despite lots of effort and investment – is plummeting (and very few get even a proportionate share of relevant traffic let alone the lion’s share).

There are two main reasons, each with their own symptoms, why your SEO efforts are failing.

Siloed approaches

Too many businesses treat SEO as a separate function rather than building it into the overall marketing mix leading to:

- An over-reliance on branded or irrelevant search

Organic traffic is driven via branded terms, meaning you’re only visible to those who know you already. Or worse, keywords that don’t matter altogether. It’s a disconnect with the strategy of the business.

- Content that doesn’t make an impact

Your content lacks the depth and credibility needed to raise eyebrows, attract audiences and gain industry respect. It’s over-indexing (if you’ll pardon the pun) on traffic over user experience.

- SEO efforts drive traffic but no pipeline

Over-reliance on top-of-funnel terms which aren’t mapped into a fluid user flow with a logical next step, so traffic drops off. It’s failing to join up marketing disciplines. - Over-indexing on vanity metrics with unclear ROI

Reporting on meaningless metrics like bounce rates and average ranking position, which don’t showcase the true impact organic search has on your business. It’s an analytical hole that could be filled.

The shifting Google relationship

The ongoing changes in SERPs has retrained many a marketer’s eye from organic to paid thanks to:

- Low organic results despite endless effort

Languishing within the forgotten pages of Google means no impressions or traffic despite time and money spent. 95% of clicks happen at the top of Google but it’s harder to get there when the space is occupied. - A focus on buying traffic rather than earning it

Turning to paid search to drive pipeline has proven equally fruitless for many: paid costs are growing to the point where it’s hard to see returns on investment. That will worsen: Google is increasing the costs of ad spend and the space dedicated to PPC ad space, reducing SERP space for organic.

And, if these two reasons didn’t seem bad enough, there’s a new kid coming to town to shake things up even more.

AI and SEO

The introduction of AI will see Google work harder to make search results more accurate, personalized and efficient.

If meeting, even anticipating, a user’s unique needs becomes the order of the day then the penalties for generic, low-quality and, let’s face it, dull search-driven content will simply multiply.

So all doom and gloom then? Well, no. If you work in the niche and rarefied industries of B2B then maybe it’s all about to go your way.

Don’t bring B2C search weapons to a B2B marketing gunfight

As we’ve more than hinted you need to stop treating SEO as a standalone department with a B2C-like mindset. B2B SEO is fundamentally different.

- Quality trumps volume: Where B2C focuses on high volume vanity keywords, B2B is more often about low volume (sometimes extremely low volume), high-value keywords. It’s quality before quantity.

- Prospect journeys are complex: B2B customer journeys are rarely the one-dimensional, simple B2C approach. B2B sales are generally complex, multi-stage, multi-person journeys and SEO efforts have to be calibrated for that

- A long-term perspective wins: B2C is inevitably a short-term perspective (‘buy my thing, buy my thing, if I give you 20% off will you buy my thing?’) Most B2B sales are long-term plays involving buying groups with very different needs – line of business managers care about different things than the procurement department, CIOs value different things to CFOs.

- Crap content is a scourge: You can never deliver low-quality or mediocre content to a high-brow, expert audience that wants complex, difficult questions answered before they jump into your pipeline. (This is the biggest mistake B2B tech firms make.)

This B2B mindset is increasingly in line with the personalized vision for AI: a technology moving in line with our skill sets.

There’s no ‘I’ in team

You’ll find the winners looking at what their sweet spot customers care about. They develop the right content to match their prospects’ intent and answer all their questions accurately (and entertainingly) while promoting that content well off-site.

The best organic teams attract an unfair share of the right, high intent traffic, balance it with paid budgets, and have successful sales activation efforts to build sustainable pipelines over the longer term. And make it seamless.

Successful B2B SEO is a team sport even though most B2B firms still see it as a standalone discipline designed solely to game the Google algorithm.

And being a team player means you must understand the balance between content and technical experience. A lot of great content goes unrewarded thanks to failing technical or off page experiences. But, no technical tweaks will compensate for low-quality content that fails to answer prospects’ questions well.

The solution is always bringing it together. Getting out of your silos. Work with the best researchers, writers, developers, strategists, conversion rate optimisation, PR teams and data teams. Get the right traffic. And then galvanize it into action.

The right way to deliver best practice B2B SEO that works is by combining four disciplines into a single approach:

- Search Strategy: Building recommendations based on the ever-changing search landscape, a deep understanding of your brand and proposition, and most importantly, empathy for your clients and potential customers.

- Content Strategy: Producing pieces that can move markets and engage prospects on the right level.

- Technical SEO: Creating digital experiences that meet Google requirements and streamline UX – straight out of the box or tailored to specific needs.

- Off-Site Organic: campaigners who get your programs in front of the right people with the right message to boost E-E-A-T credentials.

Together, these teams work together to deliver the best part of B2B SEO.

The B2B search play

So it’s not all doom and gloom after all. The organic opportunity is simply becoming more targeted and sophisticated. Just the way we like it.

But nobody said it was going to be easy. You need to excel at the one thing too many organizations just can’t seem to do: collaborate for success.

A great marketing team won’t struggle to see the value of search in meeting the needs of your users. And they’ll be working together to deliver end-to-end marketing solutions based on the experiences that start with an immediate or complicated need being expressed on Google.

And the more niche it becomes, then all the better for us.

Learn how to do B2B SEO the right way.

Jon Miller recently said that the B2B go-to-market playbook is kaput. That’s the same Jon Miller who practically invented that playbook at the dawn of inbound marketing. You know, Marketo and Engagio founder and CMO at Demandbase (and, it just so happens, serial Velocity client). That Jon Miller.

I agree with Jon that most (not all) B2B tech businesses are struggling to meet the pipeline needs of the business and the main reason is that they’ve either neglected performance brand strategy altogether or just found it too hard to mesh with their performance marketing efforts. Data driven branding efforts are like that empty town in westerns, filled with tumbleweed and lack of purpose.

Growth is harder than ever to deliver. Non-marketers – salespeople, senior executives and CFOs – were thrilled a decade ago when marketing claimed to be fully accountable for the money they were spending as a result of the marketing automation and data revolution. The excitement has turned to ashes for many B2B tech firms and CMO tenure is lower than ever. All those crappy eBooks, product-led campaign dross and ‘I just wanted to follow up my email last week’ carpet bombing have alienated most prospects. Few are paying attention.

The penalty of sugar rush

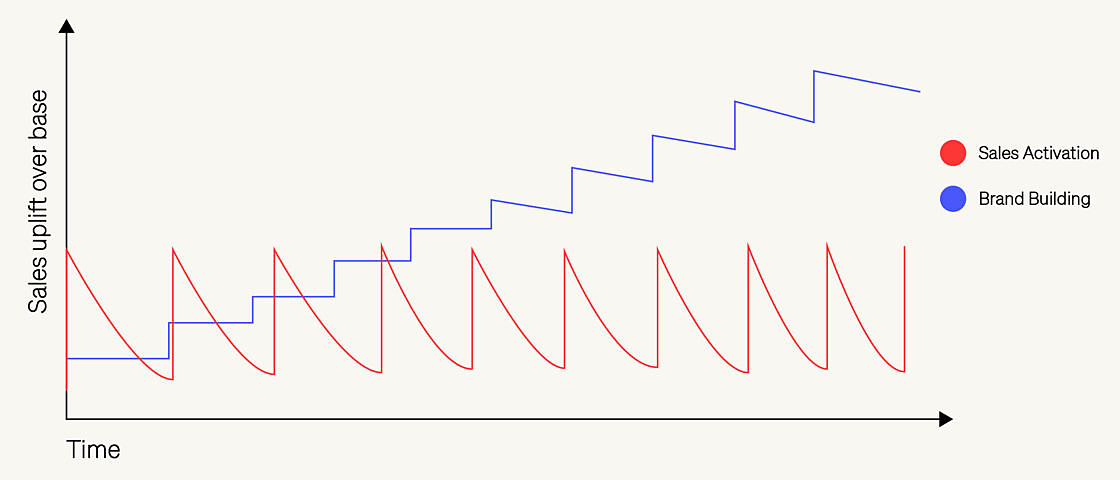

The sugar rush leads dilemma is largely at fault here. In the last decade, sales activation became the new religion. It’s understandable: non-marketing managers expect marketing to deliver on ambitious growth KPIs; the VC and PE tough guys often impose their own one-eyed marketing models centered on driving and converting leads quickly; public markets are obsessed with growth – and if you’re a SaaS company expanding less than 20% you’re a failure; and lead volume and pipeline ambition are the measure of a CMOs virility.

But an obsession with sales activation strategies frequently bites B2B marketing teams on the backside. Some companies are really good at it, but most are building campaigns with a half-life shorter than popcorn. Initial results may look good, but longer-term, the meal tastes like air and cardboard and you get indigestible matter stuck in your teeth. The high disappears fast, leaving just an empty, hungry feeling that makes you angry and leaves your non-marketing colleagues rolling their eyes. Sales reps in most B2B tech firms ignore up to 70% of leads provided by marketing. Nearly three quarters of the content produced by marketers to power campaigns is never used by sales or read by customers. The result: four fifths of all marketing leads die in most companies’ funnels.

A logical flaw

The obsession with sales activation has a logical flaw. The idea is that because B2B marketing is a precise science, you can pour content in at the top of the funnel and drive some leads (via programmatic, paid search or social), nurture, leave to simmer and hey presto you’ll generate a bunch of SQLs that you can pass on to sales.

But some recent work by the Ehrenberg-Bass Institute says that only one in twenty of your prospects are in the market to buy at any time. Even my rickety mathematics says that means 95% of potential buyers are not ready to buy. If that’s the case, two things become clear. The first is that you and all your competitors are in a bare knuckle street fight to convert one twentieth of the market. And second, the remaining 95% will probably not respond to hard sell product campaigns no matter how often you hit them over the head. No wonder B2B pipelines are so under pressure.

Binet & Field have shown conclusively why brand building is so important in B2B.

Sales activation in its purest sense should be all about converting brand preference into immediate purchase responses. Brand building is all about driving brand preference among your best prospects, which in turn reduces their price sensitivity. Brand building, they conclude, is the main driver of long-term growth and profit. Your future pipeline comes from brand building.

Ty Heath from LinkedIn agrees:

‘Most of your growth potential lies in reaching people who won’t buy from you today, but who will buy from you in future.’

Brand is performance

So, it turns out that brand is performance. Performance brands don’t just win more business, they shape the whole marketplace over many years.

So if short-term sales activation strategies go together with branding like an electron cleaves to protons and neutrons, why do so few B2B tech firms abandon any thoughts of brand and focus on short-term one-off demand gen campaigns to drum up some MQLs?

Well, one reason is that most B2B marketers believe that brand is a B2C thing; and it’s true B2C does brand better. We’re purportedly better at long, complex sales cycles, unwieldy buying teams and rational arguments.

The other is that it’s hard to build a powerful, compelling story and marry that to your content and performance efforts when your team is siloed around a set of disparate disciplines. The evidence that people don’t care about brand is the flood of content effluent produced by the vast majority of B2B firms. This is content produced for content’s sake with very little focus on what’s needed to build relationships with buyers, particularly buyers not ready to buy. Prospects are not reading much of that content. It’s boring, it’s not relevant and its mediocrity signals that they shouldn’t work with this firm. If it’s true that brands struggle to get prospects to read boring, mediocre stuff, why do so many companies continue to produce exactly this? Getting people to engage is what everyone needs to plan to solve.

On top of that there’s a specious belief that B2B buyers don’t care about stories powered by emotion. Actually, B2B buyers are humans first and purchasing directors, CFOs and data analysts second. When B2B marketing makes people feel something as well as think something, that combination is lethal (emotions are intrinsic to brand).

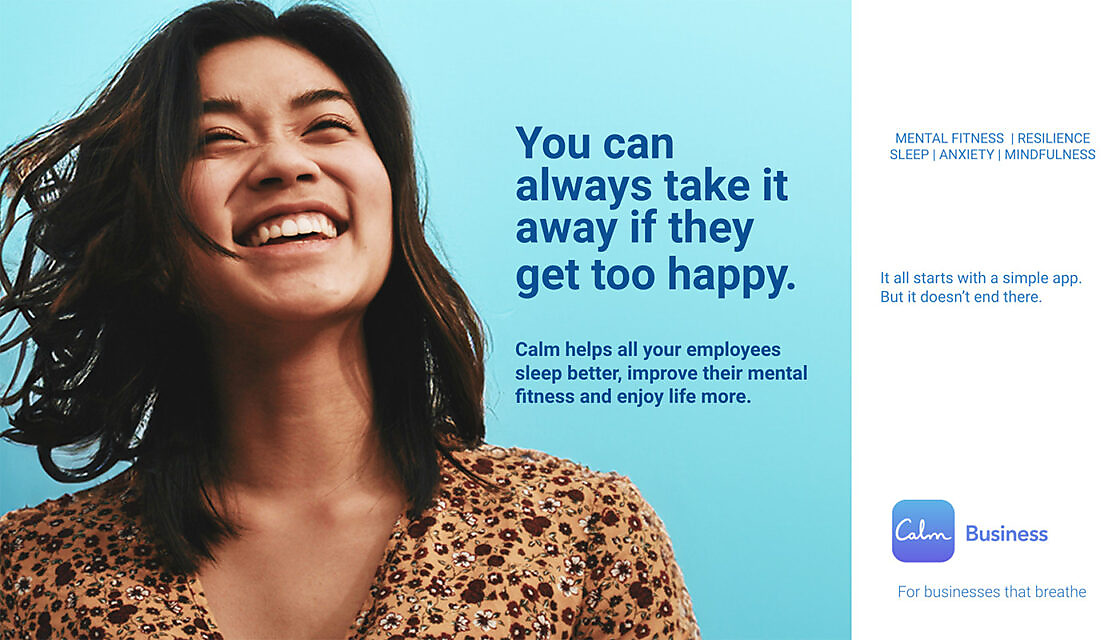

The I’m a Mac, I’m a PC campaign from Apple that showed Mac users were cool and PC users just weren’t is a classic. We worked with Calm Business to help them promote their app as an employee benefit. By making people happier and healthier, Calm clearly drives business benefits. We chose to focus less on these business benefits and more on an empathetic story: that the best companies don’t use Calm to make money, they do it to help people succeed.

We were evangelizing a new mindset: that the increasing uncertainty in the business world has created a perfect storm of stress that the best employers have recognised and are doing something about. They want to support employees to build the resilience to handle the epidemic of stress. Here’s some (non-designed) creative that drove our work:

Great brands have a distinct point of view about the world that’s based on some core beliefs. If you can express that confidently, people will buy your stuff.

Galvanizing Story

We talked about Velocity’s approach to B2B Blueprints in the last article. Our blueprints start with what we call a Galvanizing Story which then is tightly integrated with the performance plan. The galvanizing story powers the blueprint and the blueprint powers everything else.

With a galvanizing story, everything – strategy, content, creative, website, channel marketing, sales calls and performance marketing – all have a shared focus. Without a galvanizing story, all of your marketing efforts are higgledy piggeldy, made up of separate tactics often springing from different tactical goals.

The result is marketing that costs too much and doesn’t work as well as it could. The galvanizing story unites all your marketing in one place and – with the blueprint it engenders – drives short-term lead gen success and long-term brand building. A galvanizing story is a narrative that explains why anyone should buy your product, why you brought it to market and why all that matters.

Our process works for any B2B tech firm, though it’s optimized for ambitious middle-sized companies who want to move fast and who may not have the team that can deliver strategy and performance. We believe brand sits at the heart of all those dashboards and data and go-to-market plans and revenue expectations. Without it, B2B companies are stuck in a one dimensional performance world with diminishing returns. With it, their lead gen works more effectively and they build the future pipelines that deliver growth over the longer-term.

This is the second in a blog series about the new B2B marketing playbook. The first in the series is all about why pipelines are being strangled, organic performance is declining and the cost of paid media is out of control. This second one is about the new B2B marketing blueprint. You can check out the others in the series at the bottom of this piece.

When I recently stumbled upon Jon Miller’s insights on his new B2B Growth Playbook, I found myself nodding in agreement. If you haven’t come across it yet, it’s an insightful framework that challenges the outdated strategies we B2B marketers have relied on to spur growth over the last decade.

Jon’s views struck a chord with me. Not only because his proposed methodology mirrors almost perfectly our approach at Velocity when crafting digital marketing audits and blueprints (more on this later) but also because it echoed a feeling we’ve had for a while with our own clients. Coincidentally, we recently explored this very topic in this blog post.

Something is shifting in the realm of B2B marketing

It’s hard to put your finger on it just yet, but it’s there, quietly brewing beneath the surface. Perhaps it’s the lingering disillusionment with data-driven marketing, once celebrated as the most groundbreaking trend since I started my journey in B2B marketing 15 years ago but now facing scrutiny (”Why are my leads not converting?!”). Or maybe it’s the rapid, mind-boggling, pace at which AI is reshaping our industry. The tech sector’s post-pandemic downturn and apparent recovery add another layer of complexity, contributing to what feels like a perfect storm of change to come. Things are about to get real.

The exact shape of this new digital marketing era is yet to be defined. But one thing is clear: The importance of revisiting the fundamentals that underpin truly exceptional marketing has never been more important.

In a landscape where marketing teams are grappling with cutting-edge concepts like generative AI, new search engines and LLM-driven content personalisation, those who fail to get the basics right will find themselves at a significant disadvantage. Very soon.

For the seasoned digital marketer, the foundations I mention may not seem particularly groundbreaking. However, for those of us deeply immersed in the day-to-day realities of managing B2B marketing audits & campaigns, the nuances between theory and practice are as profound as the gap between your MQL and SQL conversion rate (ouch).

I’m talking about mapping out your baselines to establish your team’s goals and priorities. Aligning those goals with the best channels and KPIs. Effectively running always-on, full-funnel campaigns. Understanding the role of each paid media channel in your GTM strategy. Honing SEO skills. Getting your cost per lead under control. Making that Looker Studio dashboard pull in the right data in real-time so you can go back and optimize what’s underperforming.

These topics are staple chatter around the marketing department’s water cooler or Zoom call. But despite their fundamental nature, they are also often undermined by the complexity of platforms and data sets, bloated tech stacks, poor lead conversion and outdated problems that have lingered for over a decade.

To me, defining the new B2B growth playbook sounds a lot like going back to basics. Meaning, Metrics and Mojo. Being great at the basics. Excelling at the fundamentals to prepare ourselves for the more complex challenges ahead.

So. Let me unpack the practicalities of how we guide clients through this process.

Enter the B2B marketing audit

Our initial step in any digital marketing audit is understanding where we stand. We call this the Audit Phase: Hardcore deep-dive fact-finding. This isn’t just a glance at what brands are up to with their marketing and sales efforts; it’s a thorough examination, season-one True-Detective-style delving deep into the nitty-gritty details of things.

Our approach here is multidisciplinary, diving deep into brand messaging, creative and performance elements. We bring together thoughts and ideas from folks on the client’s side, all backed up by rigorous data analysis which involves scrutinizing SEO metrics, delving into GA4 analytics, exploring HubSpot databases, reviewing past campaign performance and checking out what our competitors are up to.

To streamline this audit process and zero in on the essential details, we create tailored marketing performance questionnaires. These are designed to guide these initial conversations and extract the specific information we need to shape our upcoming strategy. They look like this.

Here are just some example areas we explore at the audit stage:

Search

How are people searching for and discovering topics or solutions related to this client?

How do competitors perform in areas we aim to target (and avoid) with our existing or new content?

Where can we identify clusters of search to locate our high-intent prospects?

Paid Media

How have historical campaigns performed, including PPC, Paid Social, or Programmatic Advertising?

What recommendations can be made to improve technical setups or optimize existing campaigns?

How do we define target audiences and determine where to find them?

Web

How effectively is this brand’s website configured to support the envisioned campaign type and user journeys?

Do we have a data layer on the back of the site that will allow us to identify the web baselines that will evolve into KPI reporting?

How well are we equipped to report on the content and campaigns we plan to create, and what adjustments are necessary?

Marketing Operations

How can we examine essential data capture workflows, such as forms and field mapping?

In what ways can we analyse CRM databases to assess their alignment with the company’s ICP?

What approach should we take to evaluate the current lead management system and suggest any required enhancements?

How do we review creative templates for key assets, including landing pages or emails?

Sales & Marketing Alignment

How are leads currently handed over to Sales?

Is there a Service Level Agreement in place between Sales and Marketing?

What is the mutual definition of a “good lead” for both Sales and Marketing teams?

Can we map out the entire funnel, detailing the owners and their responsibilities?

How do we identify gaps for improved collaboration, documentation of processes, and the development of sales enablement materials?

Messaging & Content

How can we delineate the structure of this company’s content library?

How do we identify prevalent themes, topics, and formats within the content library, and how can we augment this with SEO and web analytics to assess quality versus quantity?

What criteria should we use to evaluate which content pieces are potential candidates for updates to align with the program’s vision and messaging?

How do we pinpoint the best-performing content, considering both engagement and commercial outcomes (e.g., top content for driving traffic versus generating leads)?

Moving from data to conclusions

What’s the payoff of this exhaustive audit?

Simply presenting pages upon pages of data and findings would not be particularly useful to anyone. So a crucial task is to distill and rationalize this information, searching for the underlying trends. By the end, once every team expert from each field has pooled their insights, the job is synthesizing all this often disparate data into a coherent whole that can serve a specific purpose.

The result is a comprehensive, practical overview that translates those fragmented data sets and platforms (e.g. your paid media accounts, your website analytics, your CRM or your SEO performance) into insights, questions and hypotheses to build upon with our new strategy.

This process doesn’t just shed light on the current state of affairs and underlying issues. It also sets the stage for us to establish baselines (we are quite particular about our baselines at Velocity) for future performance and develop hypotheses for how to address existing gaps. Take a couple of examples:

- Say this company doesn’t have a paid search campaign live for branded terms, but we can see that they’re in a competitive space, with multiple competitors bidding on their name. This might be a sign to consider building a branded campaign separately, monitoring CTRs from SERPs to see the impact of such a tactic.

- Or maybe the company is suffering from a lead quality issue, where only a small percentage of marketing leads are making it to the later stages of their funnel. This might point us to evaluating different aspects of their lead qualification process, such as their scoring model, lead assignment process or Marketing & Sales alignment.

There are countless other examples of insights and questions that can be uncovered through a digital marketing audit, but the key principle is to establish those connections and patterns between platforms early on. This gives us the raw material to build upon as we craft the plan:

- Why does it matter that your bounce is above 55%? → Let’s dive deeper into page-level analytics to identify which pages are underperforming and why. Should we consider A/B testing different content approaches or refining the user experience to keep visitors engaged longer?

- Why should you care that your site visibility is way below your competitors’? → Let’s analyse our competitors’ content more deeply and look into gaps in your approach. How do we increase the quality and relevance of our content or optimize our site structure and backlink profile?

- Why are only 2% of our LinkedIn Ads leads making it to the MQL stage of our funnel? → This suggests a disconnect between the ad content and our audience’s expectations. Do we need to review our buyer personas to refine our targeting? Let’s experiment with different ad formats, messaging, and landing pages.

You get the point.

A comment we frequently hear from clients at this point is the immense value of having all information meticulously documented for straightforward reference. Perhaps unsurprisingly, internal teams are quite often in the dark about the activities and insights of their peers in different departments. So having a neutral party like your beloved agency connect these dots and systematically organize those information silos proves to be exceptionally useful.

Drafting the master plan

With a wealth of data in hand and hypotheses ready for exploration, the stage is set for the real ‘heavy lifting’ in this process – writing the plan. Each blueprint at Velocity springs to life under the guidance of a marketing campaign strategist and a team of specialists. The strategist charts the course for the blueprint, in close partnership with a dedicated team of account and project managers whose role is essential in orchestrating the collaboration among individual experts and contributors to the plan.

Here are the essential elements every blueprint should address (if you read Jon Miller’s post at the beginning, you’ll spot the similarities with our process):

- Context: The campaign brief, shaped by our audit and research phase.

- Goals and KPIs: Our objectives and the criteria for success.

- Audience: Our target demographic and their defining characteristics.

- Creative Platform: The messaging strategy to address audience issues and the necessary content.

- Channels: Where to engage our audience and the strategy for each tactic.

- Alignment: Necessary improvements in other areas, like sales and marketing alignment, impacting the campaign.

- Technical Considerations: Technical adjustments or implementations required.

- Reporting: The mechanisms to track effectiveness based on defined KPIs.

- Next Steps and Owners: Clarifying ownership and detailing the next actions for all team members.

The real challenge of any blueprint, and perhaps the most critical aspect, is ensuring cohesion throughout the plan so that every piece of the puzzle, whether that’s aligning web analytics to SEO projections or lead generation goals to the right Paid Media budget, not only fits seamlessly into place but provides value to the whole of the plan.

Why blueprints are the central hub of our strategies

We see campaign blueprints as our go-to-market guidebooks. Think of a blueprint as a detailed manual that compiles all the insights and inputs from various specialists—from creative directors and SEO experts to paid media strategists and analytics pros, creating a cohesive plan everyone signs off and is happy to follow.

It’s like having a roadmap that answers all your questions about the campaign at hand. Need to review the challenges and demographics that define the campaign’s audience? It’s all there, in the blueprint, clear as day. Need the nitty-gritty on our paid media approach, budget and forecast? Look no further–that’s in the blueprint, too. But what about the keywords our writers need for crafting those engaging blog posts? You’ve probably guessed it–they’re all neatly laid out, practically jumping off the page, in the blueprint.

The beauty of a Velocity blueprint lies in its depth. They act as a prism, transforming abstract concepts into a concrete, actionable marketing plan. Without a blueprint, you might find yourself with just a (likely impressive) sketch of ideas that may or may not be ready for execution.

Want to see a Velocity blueprint in action — or maybe orchestrate your own? Follow this link to download your free copy of The Big, Beautiful, B2B Blueprint now.

Dear B2B,

Has it been five years already? How time flies.

I’m going to start with a bit of a confession…

Five years ago I fancied your cousin.

(Stay with me, I promise I’ll bring it around).

In truth, B2C has been eyeing me my whole life. I still can’t turn a corner without seeing them. On every building, down every supermarket aisle, in-between reruns of Friends, after every swipe of my phone…

They were flashy, exciting, vibrant, hopeful, beautiful, clever, funny, happy and burst into my life (even when I didn’t want them to). It was all I knew.

But then I met you.

And I’ll admit, it wasn’t the smoothest of starts:

We didn’t lock gazes longingly across a smoky dive in Paris; I didn’t climb a sparklingly-lit ferris wheel and force you to say yes to a first date (The Notebook is a stupid, stupid film).

No, it started by mistake. And I sort of hated you. Plus, I still fancied your cousin.

Looking back, I wasn’t so attractive myself. A not-so-fresh-faced, hungover know-it-all straight out of an English Literature degree with unfathomable debt unknowingly accumulated.

I had very quickly realized that an in-depth knowledge of Wildeian set design and Spanish cinema weren’t exactly gold dust when it came to getting a real job.

Being turned down from every B2C marketing role I applied for, I stumbled into a B2B agency without really knowing what happened, or what I was doing.

And then, BAM.

TECH. COMPLEXITY. STRESS. AHHHH.

My young mind felt like it only had short gasps of time to wonder what the hell it had gotten itself into.

But then…

Something happened.

You started to grow on me.

Not like a horrible growth. A nice one. A lovely one, in fact.

Because you’re actually really fucking interesting. In a way your cousin just isn’t.

With you, I got challenged every day to learn something outside my comfort zone. Really interesting stuff about some mad technology that makes the world go round.

Our conversations were intricate and nuanced – and I’ll admit that I felt out of my depth at first. But then I got good at explaining the complex things I wanted to say simply, and with a bit of mojo too.

You showed me that to feel truly rewarded, I needed the invitation to explore, grow and understand – only then would my writing truly make me smile.

No shade on your cousin, but they never offered me that.

Being creative with you isn’t about big and broad flamboyant gestures, it‘s about solving puzzles, about telling layered and intricate stories from multiple perspectives that build into industry-sized change.

Speaking not just to the mind, but to the very heart of people’s challenges and aspirations.

If liking that makes me a nerd, shoot me (please don’t).

And then I got to know about the stuff that makes you tick: Performance, SEO, lead generation.

Welp.

At first, the accountability scared me. But you taught me that great creative work is only as good as its results.

Suddenly, I was delving into keywords, user journeys, conversion rate optimization and A/B testing to help experts find and choose your solution for their problem — it was invigorating.

You always wore the trousers in the relationship but I didn’t mind. You demanded not just intelligence but a kind of smart that was adaptive and resourceful.

Your allure isn’t the hot-shit, one-and-done transactions of your cousin, but the meaningful relationships you forge. You’re more than just quick wins or flashy ideas. You’re grounded in the real world, intent on addressing real needs.

No manipulating; just helping smart people solve complex problems and do better work.

WOW.

Sorry, that all came gushing out a little.

Basically, you’re alright. And if I could go back five years and tell past me that it was the OTHER cousin I should be idolizing, I would.

So here’s to ten years, and maybe even twenty (if my series of Spanish-inspired films never takes off).

With love always,

Me x

Subsequent articles will be about setting up demand gen blueprints, the relationship between strategy and performance and SEO.

15 years ago, just after Doug and I founded Velocity, we wrote a piece called the B2B Marketing Manifesto.

It was written when B2B tech was still dominated by direct sales. But B2B marketing was actually on the cusp of becoming a key part of every company’s revenue engine, of becoming accountable to the rest of the business for the first time. (Before, its job was pretty much limited to being the Sales department’s PowerPoint lackey, deciding what color the logo should be or spending months designing the exhibition stand). The Manifesto was a call to action and a plea for ambition. It prefigured the evolution of B2B marketing and has been downloaded millions of times since publication.

Since then, lots of companies have put their marketing tech stacks to work, driving revenue. But lots haven’t. Often the ones that struggle are the smaller, ambitious companies with limited marketing teams. It’s time to do something about that.

The inbound era: a (very) brief history

The transparency of the Internet encouraged prospects to conduct their own research unencumbered by a vendor’s sales teams. An almost mythical stat emerged that summed up the whole inbound marketing era: buyers apparently spent 67% of their time on independent research before contacting sales. Content marketing exploded and we built our business on the back of it. At Velocity, we likened the shift from sales-led to data-led marketing to the moment in the Wizard of Oz when the film moves from black and white to color. Marketing departments were not in Kansas anymore and we challenged them to respond.

Back then, the inbound marketing world was linear and sequential: first the marketing happened, then the sales. Marketing’s job was to create ‘leads’, nurture them so they became qualified opportunities that could be handed off to sales reps to close. A bit like a relay race.

The changing face of B2B marketing

Quite a bit has changed since those days. How customers buy has outrun how most vendors sell. And beyond the companies that are clearly getting their data orchestration right, the majority of B2B marketing departments have little idea whether the right people from the right accounts are interacting at the right time with the things marketing produces.

At Velocity, we see a lot of companies struggling in critical areas:

- Pipeline meets cliff: They continue to struggle to create enough pipeline. And metrics are generally worsening. Most companies are spending a fortune on their paid channels and the CPL is astronomic, somewhere between terrifyingly bad and catastrophic. Organic performance is in the toilet.

- Sugar-rush or dopamine leads: Teams are set up to measure campaign touches, calling them leads and failing to link those into long-term demand gen outcomes. ‘Leads’ come from a series of unconnected campaigns and are generally rejected by sales teams. You know the sugar rush is bad for you but you don’t know what else to do.

- Talk to the hand: Your sales team is taking chunks of marketing into their own hands, sending more emails than marketing to ‘prospects’ at the top of the funnel using tools like Outreach and other sales prospecting platforms – and they’re not using your expensively produced content at all. They hate the leads you generate. The old ‘we’ll control the top of the funnel and you handle the bottom’ truism is long gone.

- The ancient mariner conundrum: You know: data, data everywhere but not one drop of useful insight driving long-term, robust pipeline. You can’t make sense of your marketing data because it’s so fragmented and contradictory. And you can’t connect it to the journeys your prospects are taking today.

Together these things add up to a low level despondency and collective loss of mojo among senior B2B marketers. Yes, there are lots of companies out there doing a great job, but many have failed significantly to reap the benefits of the accountable marketing world.

So why is this all happening and what are the implications?

From the work we do with clients, one of the main reasons for this malaise is that, while buyers no longer buy linearly, many B2B firms continue to be set up for a ‘first marketing, then sales’ world.

Sales today is just one channel to customers and probably not even the most important one. Gartner reckons that only 17% of a prospect’s time is spent interacting directly with sales reps. That’s not 17% with each vendor; it’s 17% of all the time they spend in research regardless of how many vendors are in the process. You may be running the linear marketing and sales relay race but your prospects are competing in a completely different team sport altogether. Closer to a rowing eight, pulling and applying the power together when necessary to win.

Buyers have become channel agnostic. They use all of them – web, paid, social, reps, third parties, email – simultaneously and expect you to be able to orchestrate that effectively. While everyone has become familiar with all the disciplines and tech that make up the modern marketing department, they’ve found it hard to transition towards managing today’s multi-channel information orchestration challenge. (Many have also failed to realize the implications of that for their SEO efforts too, and we’ll write about that in a later article in this series).

Most marketing teams are still siloed, often around disciplines, and produce siloed data that’s hard to connect to other data sources and glean insight from. Marketing teams do not map to modern customer journeys or the number of people that take different roles across problem identification, solution evaluation, from requirements building and selection, from negotiation to post sale value creation.

| Relay race | Rowing race |

| Linear, sequential, single channel, inbound-centric | Synchronized and simultaneous across every digital and non-digital channel |

| Focussed on marketing to people | Marketing to people and accounts |

| Short-term isolated campaign view to generate leads | Long-term demand gen focus |

| Noise drowns out data insight | Connected data |

| Obsession with recruiting new logos | Recruit new and nurture existing customers |

According to Forbes, tech CMO turnover rates are higher than in any other industry: a CMO in a tech firm is lucky if they last longer than two years in the job. In lots of firms the C-Suite is increasingly disillusioned about the performance of their marketing teams. While marketing is telling the rest of the team it needs a seat at the top table because it’s the company’s growth engine, everyone else is talking about them behind their backs. Increasingly, marketing is seen as a department that promises and costs a lot but nearly always under-delivers.

The new B2B marketing malaise

Marketing departments and their leaders need to shift from their linear, relay race mindset or CMOs will continue to get fired, pipelines will continue to erode and customers will look elsewhere for solutions.

We believe that marketing departments need to think about the B2B opportunity as less like a relay race and more like being in a rowing eight: where sales and marketing really work together rather than roll their eyes once they’ve passed each other in the corridor; and where teams stop making individual channel and marketing disciplines their key KPIs. One reason this is so hard to do is that platform and data complexity gets in the way. Orchestration of different data sets is tough and getting insight isn’t easy. This excuse is weak. At Velocity, we’ve developed a blueprint process that helps clients make the transition to rowing – and we’ll expose that blueprint process in the next few articles in this series.

The focus for our blueprint process are what we call ambitious, middle-sized tech firms struggling with the pipeline challenge. In the series, we’ll show you how to:

- Map your marketing data to today’s B2B customer journeys. That involves embracing new KPIs and better channel orchestration.

- Use SEO to drive down paid costs and turn organic into a demand gen powerhouse.

- Understand how to use strategy and brand to drive marketing performance.

- Deploy AI to orchestrate all your channels simultaneously.

Read the next article in this series called The Universal Digital Marketing Audit. In it, we’ll show you how to navigate the evolving landscape of B2B marketing, starting with a thorough audit process. This is the first stage of Velocity blueprints, our strategic go-to-market guidebooks.

Spotify Wrapped is one of the biggest marketing success stories in recent history. For a few weeks every year, Spotify’s marketing team grows by tens of millions.

There are hundreds of posts about how Spotify Wrapped has nailed personalization. But, at Velocity HQ, we see it as a perfect case for the value of data-generative content.

In a post-cookie world, brands are looking for new ways to learn more about their customers. First-party data is the answer.

Third-party data is collected — or more realistically, bought — but Spotify earns first-party data (i.e. information collected from their subscribers when they interact with the app). And users, like me, are only too happy to volunteer it. Why? Because we’re completely engaged with what Spotify offers.

But the challenge for B2B brands is: you aren’t Spotify. You haven’t got millions of people voluntarily opening the app on the tube every morning to check what their Daylist says about them.

That means:

- People aren’t already voluntarily engaging with your brand: The value exchange for Spotify users is incredibly obvious. You give up your data but you get to listen to the music you love whenever and wherever you want.

- You may not have any real user data to start working with: If you capture any utilization data at all, it’s hard to draw playful personality-quiz conclusions from the way customers use your billing software.

So, what do you have to offer? And what can B2B marketers like you steal from Spotify Wrapped?

Let’s get into it.

Earning the data you want

Users are only going to volunteer their data if there’s a clear benefit in doing so. To earn their data, you need to offer them something they want.

Alex Bodman, vice president and global executive creative director at Spotify, reveals what makes Spotify Wrapped feel valuable. He says: “We weren’t just talking about ourselves. We were giving people an interesting way to talk about themselves.”

Comparing yourself to peers is a deeply ingrained human instinct. Spotify Wrapped taps into this instinct and frames it around self-expression and social capital.

The good news is B2B companies deal in something way more tangible: actual capital. You might not have the brand pull of Spotify, but your customers would be fascinated to learn how they’re performing relative to their peers (and crucially, what they could do to improve).

The thing B2B companies can steal from Spotify Wrapped is to build an experience that triggers the same social comparison instinct, but leverages it towards a commercial outcome.

We regularly build experiences like that for clients. We call them graders.

Let’s take a look at one up close.

Why graders are a killer value exchange

A grader is a short survey that asks users 8-12 questions about their performance or behaviors in a certain area.

They earn fantastic first-party data for clients because they represent a very compelling value exchange for users:

- Users get a dynamic report that scores their performance – both on its own terms and against industry benchmarks – as well as tailored advice and follow-up recommendations

- Clients get a variety of insights (tied to a real prospect) far richer than the traditional demographic information of a form (or anonymized third-party cookies)

We recently made a grader for a client that sells automation software to independent healthcare providers. It’s a noisy market, and many prospects have already been burned by clunky, practice management solutions that overpromise and underdeliver.

The client wanted to cut through the noise with an experience that demonstrated a provable link between practice automation and overall efficiency and performance.

It’s an interesting idea by itself — but to really dial up the FOMO (and activate the social comparison instinct) we paired it with a competitive benchmark.

We sent a sample survey to a few hundred respondents and built up a bank of lookalike data to provide users with a mechanism to compare their performance against the market.

Suddenly the whole thing looks like a party in motion — users are far more likely to answer 10 questions about themselves if there’s the promise of some competitive insight at the other end.

(There’s an obvious drawback with this approach: it costs money to build up quality benchmark data. But earning data should cost you something – if it doesn’t, it’s probably a good sign the value exchange isn’t real).

Say hello to data generative content

For years marketers have treated personal data as the cost of entry for content and experiences that users are (at best) passingly interested in.

Graders are different. Instead of treating personal data as a commodity, they treat it as a source of information, and promise to enlighten users with new insights about themselves.

When the value exchange is self-evident, the marketing defense barriers fall. You can smuggle one or two carefully worded questions into the survey to capture sales insights that would set off deafening alarm bells in a traditional form.

Things like:

- What are your top priorities this year?

- What’s your software budget?

- How far through your upgrade cycle are you?

- Who’s involved in technology buying decisions in your team?

The best graders are data generative — instead of giving Sales a list of “MQLs” (i.e. people who begrudgingly parted with their email address to access an underwhelming ebook), you can pass them a list of piping hot leads with tailored talking points sent straight to the CRM (and disqualify the people who aren’t a good fit).

Some parting advice

The last few years have spawned dozens of Spotify Wrapped copycats (from companies like YouTube, Apple, Reddit and Steam).

And none of them succeed in the same way — because they’ve stolen the format (i.e. a utilization report) instead of the substance (here’s why that makes you unique).

Spotify Wrapped succeeds because it’s not about Spotify. It’s about users. And if there’s anything for B2B marketers to steal, maybe it’s that in a post-cookie world, the only way you’ll learn anything about your customers is through experiences that directly serve them.

That’s what data generative experiences like graders are designed to do: create a path to first-party data that earns the information it asks for (and delivers much richer insights as a result).

Want to introduce more data generative data experiences in your brand? Get in touch.

It was strange to read in Bloomberg and the Financial Times that 2023 wasn’t a good year for mergers and acquisitions (M&A).

Because personally, we helped out with a ton of them last year. And we’re expecting more to come – Datasite’s Mark Williams said M&A is “poised for a resurgence in 2024” in this article for Nasdaq.

Roll-up positionings are gnarly – particularly for marketers. Because if (though often when) the shit hits the fan during M&A, it’s up to marketers to scrape it off the walls and make sense of it all.

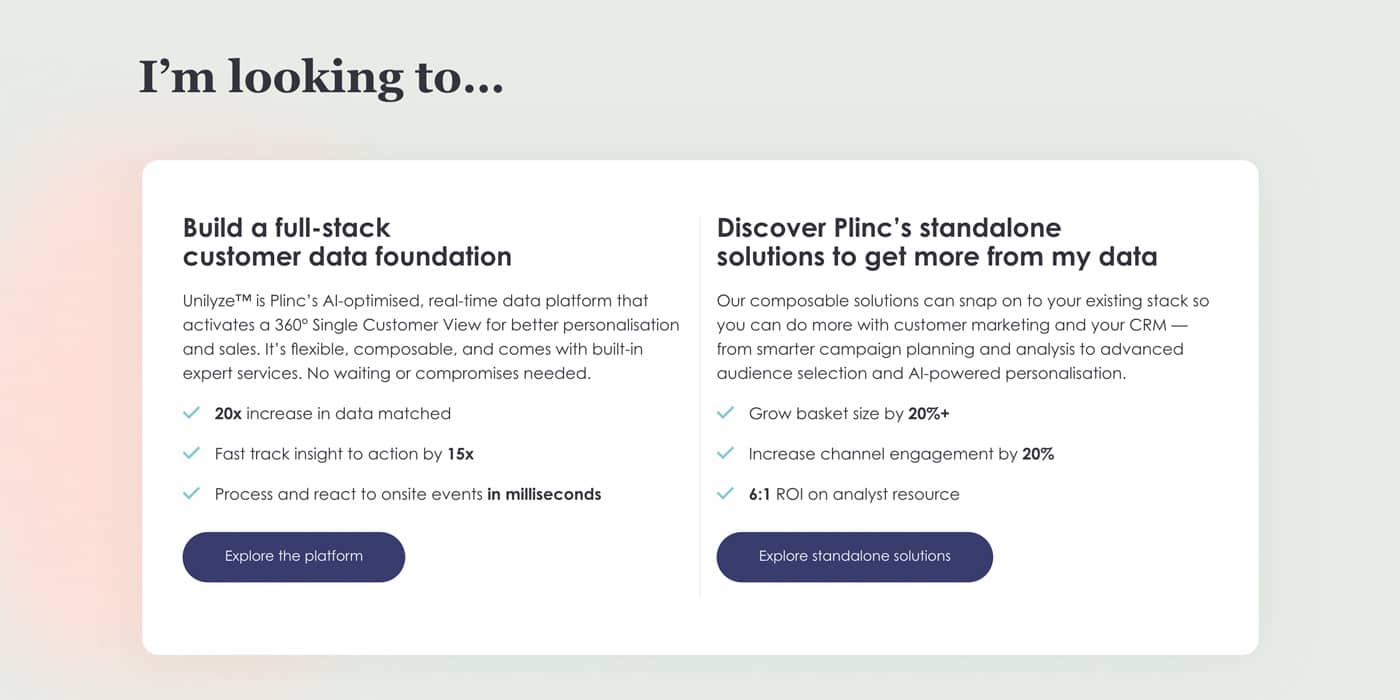

And with roll-up positioning that’s a particularly messy activity. Because, like all positioning projects, a company roll-up requires you to find a single unifying positioning story and brand to take to market. But how do you…

- Find the ‘real heart’ of a newly formed entity?

- Stop your unified story getting watered-down to the point of failure as it garners feedback from multiple stakeholders?

- Avoid becoming the referee of a company culture cage-fight between those stakeholders?

- Create something that genuinely excites the market and the newly formed business (so they’ll actually use it)?

In this blog we explore four steps to help you scale these obstacles.

But before we jump in, it’s worth noting that a company roll-up can take many forms: the cannibalisation of one product to strengthen another, or the hoovering up of a lot of small businesses to streamline operations etc.

For this blog post, we’re focusing on the “category leader play”. This is when private equity investors bring together multiple smaller (but promising) businesses with complementary capabilities — in order to create a full-service business that owns the space.

OK, let’s dive in.

Step one: Lay the foundations

A roll-up is a unique beast with unique positioning challenges.

Whilst you should stick to your usual positioning methods and principles, to accommodate these idiosyncrasies, you’ll need to adapt your approach in some key areas.

First you’ll need to create a decision-making group.

The biggest risk to a roll-up positioning is a lack of clear hierarchy.

M&A processes are scary. You’ll have a wide group of stakeholders who want to know what’s going on. Partly because they care about the project, and partly because proximity to these decisions can feel like job security.

It’s a charged situation with a lot of opinions flying around. This makes it vital to set expectations around who will be involved in the decision-making.

Doing this won’t eradicate tension entirely. The tough calls and difficult “No’s” you’re going to deliver mean there’s going to be friction at times. But setting expectations will settle a lot of minds – and stop you from diluting your message by trying to please everyone.

A good decision-making unit is a small and focused group which includes representatives from each of the businesses in the merger. All too often, a roll-up will be attempted by working with a ‘focus group’ of people who ultimately have no authority when it comes to the direction. Then the work hits the big wigs and everything shuts down.

Don’t fall into this trap.

Make sure your decision-making unit is an empowered group of the representatives we mentioned above. This unit will be responsible for reassuring the wider stakeholder group that they’ll be listened to — but also for making it clear who gets the final say.

You’ll also need to hold on tight to your authority.

Roll-ups aren’t purely a marketing exercise. But they should be a marketing-led exercise.

Because despite the all-encompassing change that roll-ups imply (across your strategy, offering, sales processes, business operations, org chart, customer relationships and more) it ultimately falls to marketing to synthesize all that change into clarity – both for the (new) business and for the market.

The trouble is that in a crisis, everyone becomes a marketing expert. You need to advocate for your own expertise in order not to get sidelined in the fray – as a passive bystander to the process, rather than as a strategic advisor.

It’s also important you know that the marketer or agency team can’t be the sole decision-making unit either. Why? Because you’ll fail to get the level of buy-in necessary for the new positioning to work.

And finally, you’ll need to adapt your timelines.

This may seem simple — but you’re going to have way more conversations and opinions to consider than with a ‘normal’ positioning. So plan accordingly. Failing to understand this and its cost ramifications can quickly sour the process.

Step two: Set direction

Once the decision-making unit has been established, it’s time to start making actual decisions.

The first part of that is finding your why.

Any positioning process is ultimately about articulating what a business does, why it’s important, and why this business’ solution is the right one.Then you’ve got to lay that out in a compelling narrative structure. At Velocity we call this the Galvanizing Story.

But with roll-up positioning, you’ll first need to get everyone on board with the ‘why’ of the merger itself.

- Why did the Private Equity (PE) investors bring the brands together? Because you share a customer base? Because your offerings are complementary?

- What’s the potential gain here?

- What’s the risk?

- How do all of the above translate into a story that’s more than just market share?

This’s not only going to help you create a compelling angle for your outward marketing, it’s also going to help you galvanize internal folks around the project too.

Once again, it’s not an easy process.

The next thing on your list is to gauge the appetite for change.

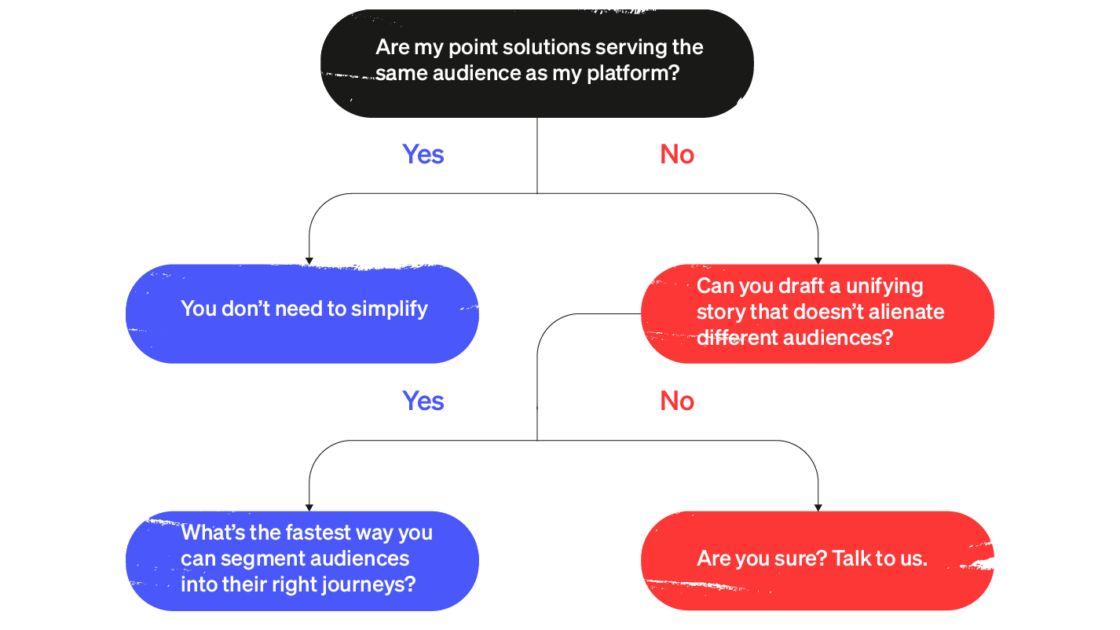

This is a vital stage, where you as a marketer need to get the answers to a couple of big questions:

Are the stakeholders ready to push for a transformative and bold story that will let them own the category (as most PE folks will want them to)?

Or are they really looking for a light-touch narrative thread to wrap around the stories they already have (because the imperative is to not spook the major customers their business models are built around)?

Knowing this before you get into actual positioning work will allow you to understand the task ahead – and save you a lot of uphill-idea-pushing later.

Step three: Setting expectations

Just as you’re having to adjust your process as a marketer, so will the businesses you’re working with — and it’ll be your responsibility to explain that.

The first part of that is explaining there’s no silver bullet.

There’s no one story, one new brand name, one new tagline that will unite everyone. As our CEO puts it, “there are no great names, only great companies.”

Which means people outside of the decision-making unit need to know they’ll be asked for validation, not permission.

At times, that might mean changing the conversation from whether or not people like it or not, to whether it works in achieving the goals we want it to.

The next bit is communicating that you can’t include everything.

This means you can’t give every key feature of all the multiple products you’re synthesizing equal priority.

This is not about creating a Swiss Army Knife positioning. It’s about finding the sharpest, most compelling throughline. In fact, roll-up positionings are a great opportunity for simplification — to jettison parts of the story or the offer that are old, unclear, or underperforming.

You’ll also need to get everyone on board with the idea that customer input will be vital for this to work.

Customer input is important in any positioning process — but with a roll-up it’s absolutely fundamental.

This is where you can reveal the kinds of common obstacles, needs, wants, and hopes that will unite the disparate offerings you’re trying to bring together.

Finally, you need to set expectations that this is a journey.

Roll-ups are complex and multi-faceted and you won’t nail every element of it in the first push.