Standing out is hard for Software-as-a-Service (SaaS) providers. It’s a crowded space full of loud voices and sharp elbows – a cool, slick product is just table stakes. To actually win, you need some extra edge.

That’s why it’s frustrating to see so many SaaS providers sit on a mountain of marketing gold dust and do nothing with it.

Let me explain.

Established SaaS providers have reams of proprietary data – endless streams of demographic and behavioural information about who their customers are and how they use the services in question.

But hardly anyone markets with it – at most it’s used for internal business intelligence and product development. And that’s a mistake.

In the right hands, this is insight-rich intelligence that (depending on the service you provide) can also reflect a wider picture for prospects – a tantalising, unbiased glimpse into areas like market conditions, industry benchmarks and even competitor analysis.

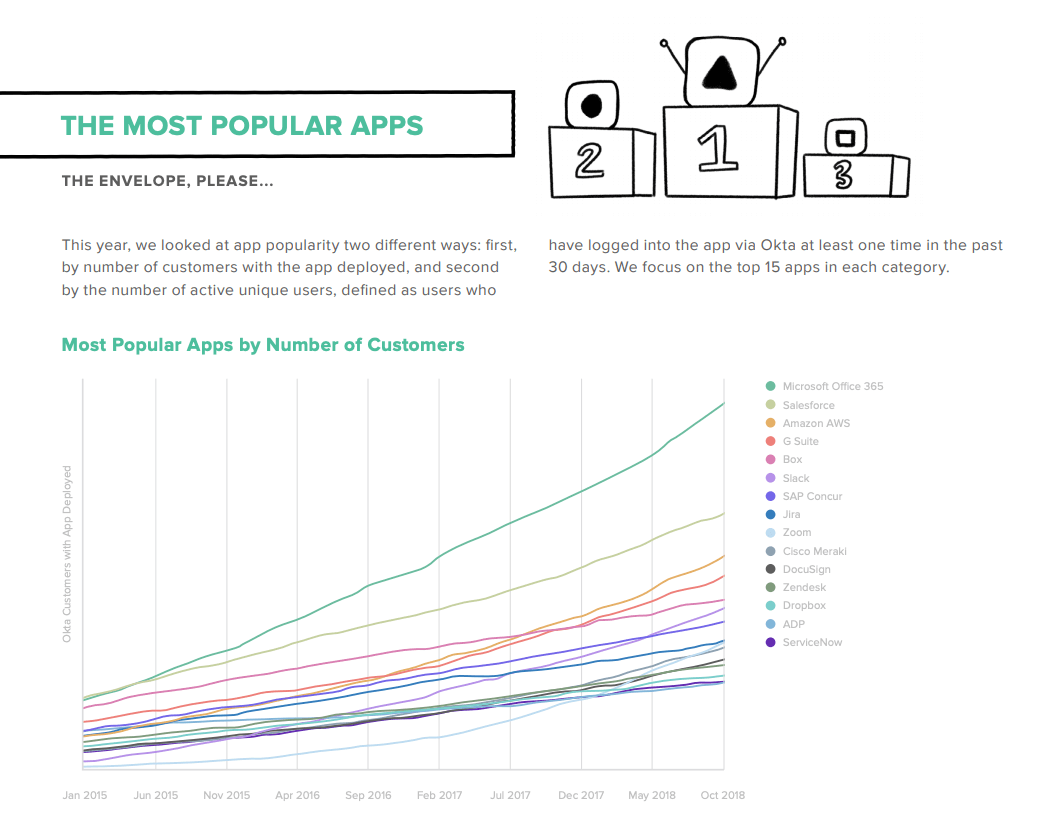

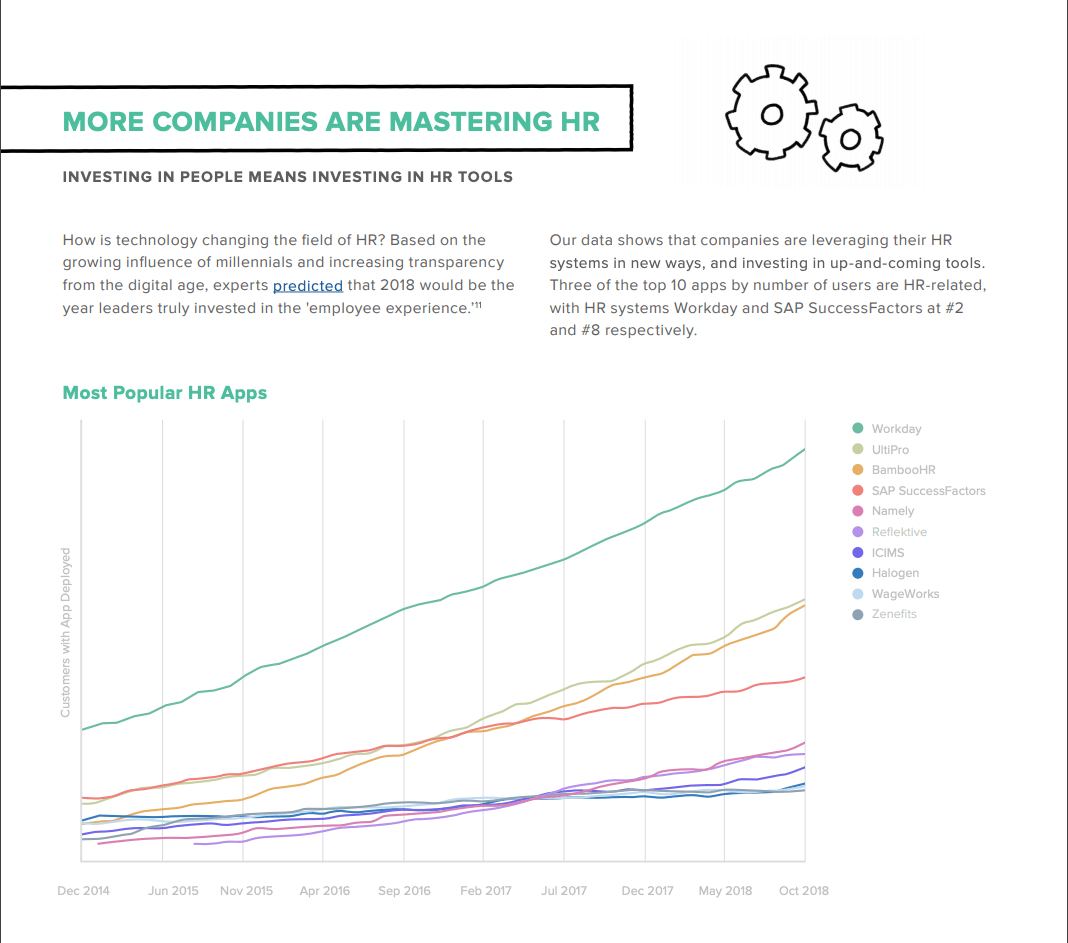

Take Okta’s recent “Businesses @ Work” 2019 report.

Okta mainly provides identity management, delivering a single sign-on experience for enterprise users working between multiple cloud applications.

This privileged position as a major authentication interchange also means they’re sitting on a goldmine of proprietary data. They have a unique view on the variety of applications and IT integrations used by their thousands of customers.

So at a time when tech stacks are diversifying more than ever, “Businesses @ Work” is a fascinating snapshot of current enterprise IT application deployment.

Proprietary data speaks for itself

Proprietary data isn’t just another flavour of vanilla marketing research or paid-for survey responses. Quite the opposite: proprietary data has some unique qualities that blow other kinds of marketing data out of the water.

Think about it:

- It’s objective, with no agenda and straight from a primary source

- It’s both broad and granular

- It’s free and continuously up-to-date

- It’s totally unique and already yours

Free, accurate, differentiated data doesn’t come along often. But it’s the first point that’s particularly important here: proprietary SaaS data doesn’t need to be spun to be valuable.

That’s not to say it shouldn’t be analysed for deeper insights, but it’s also important to remember that objectivity is exactly why it’s already valuable – something easily diminished by heavy-handed editorialising. Instead, all you really need to do is locate what’s interesting and get out of the way.

We’ll get to exactly why that’s a tricky needle to thread in a second, but as a data type, it’s a marketer’s dream: clean, honest, objective insight, that implicitly positions the company as an authority in the space. So why the hell aren’t more SaaS providers leveraging it?

Four common mental roadblocks to marketing with proprietary data (and how to get over them)

We don’t want to creep out our customers

This is a great instinct. While SaaS customers all know their data exists within a shared environment, they didn’t exactly sign up to be poked, prodded and measured next to their invisible peers.

I’d wager this is more of an emotional response than a rational one – probably less about serious privacy concerns, and more about feeling kind of icky that the SaaS provider you’ve entrusted your data with is leveraging it publicly for their own benefit.

But there are also some red lines that shouldn’t be crossed. Most importantly: you have to make sure the data you’re sharing is aggregated and could never be attached to any specific customer.

Equally, you need to find a balance between drilling down into how people use your product without revealing the content of their interactions. Which brings us to…

Who cares how our customers use our services?

The short answer is that your middle and bottom of funnel prospects care. They’re curious as hell.

Proprietary data cuts through marketing mistrust with hard numbers on how people who used to be prospects are experiencing life as customers. You’ll know you’ve really nailed it when people who’ve never even heard of you flock to the authoritative light you’re shedding on their market.

However, the slightly longer and more nuanced answer is that proprietary data has value way beyond raw usage statistics. With the right analysis, marketers can leverage proprietary data to reveal fresh insights into the wider business context from which it emerged.

That’s exactly why Okta’s study is powerful: because their usage statistics are the wider business context. You might have to work a little harder to find the “so-what?” in your data, but it’s where the most valuable intelligence comes from.

Dispassionately regurgitated stats are just as off-putting as flagrant bullshitting. It’s your job to understand how you fit into your prospect’s lives, and then bring something honest and incisive to the table.

We have too much data to work with – we don’t know where to focus

Proprietary data tends only to come in one size: holy-shit-that’s-a-lot. It’s common to feel overwhelmed when you’re working with thousands of customers across dozens of industries. But the worst outcome is getting paralysed by possibilities and doing nothing as a result.

You don’t have to shoot for the moon right away. Start by asking really simple questions:

- How big are our customers?

- What does an average deployment look like?

- How do key metrics improve over years 1, 2 and 3?

- What does all this look like on an industry by industry basis?

As you begin to feel more confident, you can start to think about the wider business context this info sits within – the “so-what” of it all. Stuff like:

- What does the activity of our customers reveal about the activity of businesses like theirs?

- What are our best hypotheses about this market and does the data bear it out?

If it helps to get things moving, narrow your focus towards high value areas at first. On a regular cadence, industry reports become a valuable document of change over time. There’s plenty of time to expand gradually – what’s important is getting started.

We don’t have enough data to work with – we’re not representative of the wider market

This is a common problem for SaaS companies without a critical mass of customers yet. But proprietary data doesn’t need massive scale to provide valuable insight.

Working with a small sample size can be an advantage if you narrow your focus into specific areas. So rather than overreaching in an ambitious industry-wide report, you could zoom in on a small subset of customers within a specific industry.

Or you could pick a handful of anonymised examples of customers doing something particularly unique with your tech – some complex, bespoke, fringe use cases that demonstrate the breadth of what your service is capable of.

Ultimately, the size of your data set doesn’t matter nearly as much as the stories you can tell with it.

Why this is really about bravery

Reluctance to market with proprietary data isn’t down to ignorance or laziness. Instead, I think it’s about bravery (or a lack of it).

Leveraging proprietary data takes guts: to publicly interpret data, to create something ambitious, and – in the Okta example above – to elevate yourself as an authority on things outside your core focus.

But that’s exactly why the rewards are worth the risk. Using proprietary data transparently and honestly to help your prospects learn something – about themselves, about the market they’re in, about what the future holds – is immediately, tangibly useful in a way most content only wishes it could be.

–

Enjoyed this article?

Take part in the discussion

Comments

There are no comments yet for this post. Why not be the first?